Opening Offshore Bank Account - Questions

Table of ContentsOur Opening Offshore Bank Account DiariesOpening Offshore Bank Account - An OverviewThe 30-Second Trick For Opening Offshore Bank AccountThe Opening Offshore Bank Account IdeasOpening Offshore Bank Account Fundamentals Explained

24). A recent [] District Court case in the 10th Circuit might have substantially expanded the definition of "rate of interest in" as well as "other Authority". [] Offshore savings account are in some cases touted as the remedy to every lawful, financial, as well as asset protection strategy, however the advantages are frequently overstated as in the a lot more popular jurisdictions, the level of Know Your Client proof required underplayed. [] In their efforts to stamp down on cross boundary passion settlements EU federal governments consented to the intro of the Financial savings Tax Obligation Instruction in the type of the European Union keeping tax in July 2005.This tax influences any cross border passion repayment to a specific local in the EU. Furthermore, the price of tax deducted at source has actually risen, making disclosure significantly eye-catching. Savers' choice of action is complicated; tax authorities are not prevented from enquiring right into accounts previously held by savers which were not after that disclosed.

e. no person pays any tax obligation on offshore holdings), and also the similarly interested narrative that 100% of those down payments would otherwise have been reliant tax obligation. [] Forecasts are usually predicated upon imposing tax obligation on the funding amounts held in overseas accounts, whereas most nationwide systems of taxation tax revenue and/or funding gains as opposed to accumulated riches.

3tn, of overseas properties, is owned by just a small bit, 0. 001% (around 92,000 super affluent individuals) of the world's populace. In simple terms, this mirrors the trouble associated with developing these accounts, not that these accounts are only for the wealthy. The majority of all people can make use of these accounts.

The 45-Second Trick For Opening Offshore Bank Account

Whenever just how to open up an offshore bank account is mentioned, a lot of individuals think of prohibited service bargains or tax evasion. Others believe that offshore accounts are only a thing for premium investors or rich people only. Well, the reality is extremely far from these two presumptions. Opening an offshore bank account is the exact same as having an account in a local bank other than for the distinction in the area.

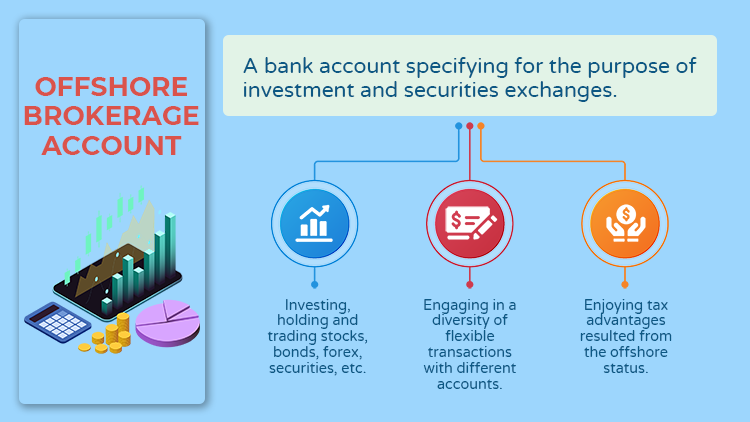

Offshore banking is a term see this utilized to specify activities that you accomplish with a checking account that you opened up outside your house nation. Such tasks consist of banking solutions such as down payments and withdrawals, firm operations, as well as financial investments. Some countries are much more popular when it comes to overseas banking, and also this is something we will certainly tackle in information later numerous nations come with various benefits.

Opening Offshore Bank Account - The Facts

The only truth in it is that many affluent people often tend to open up a brand-new checking account in a various country, perhaps to shield wealth or expand their financial investments, among other reasons. This does not imply that you can not possess an account offshore it is open for everyone. You only require to go for a banking establishment that suits your demands and economic abilities or wide range.

Some individuals assume that opening an offshore account is really difficult as well as pricey this is not real. As long as you understand why you need the account, you will certainly recognize where to start - opening offshore bank account. The bright side is that you can additionally rely upon a representative to help you open the account, making whatever far more manageable.

Therefore, understand the needs of the bank you have selected and also begin refining the documents while preparing the minimum opening deposit. Minimum equilibriums rely on the bank you have chosen for. Lastly, all try this out the kinds get submitted with an e-mail or the financial institution's internet site, as well as files are provided through messenger solutions.

Most financial institutions using offshore financial services are solvent, which implies that they are full-reserve financial institutions. They will certainly keep your complete quantity without lending it to consumers it is among the main reasons that people go offshore savings account. They will certainly also bill you maintenance and deal fees for every solution made.

Some Known Facts About Opening Offshore Bank Account.

Many of these come with operational earnings, which might make feeling if they are billing you any charge. All you require to do as a depositor to the overseas financial institution is to comprehend all the prices and investments executed on your part. You will know whether it is worth it or no.

If you are preparing to move to the more info here nation, you opened up a financial institution account, or you just desire to check out the nation, then established up the account is simply sufficient. If you want to safeguard your riches in that nation, multiply it, or take advantage of tax benefits, then you have a whole lot more to do.

This is great because you are lowering the threat of shedding whatever in situation one of the investments falls. If you remember the financial recession in the year 2007-2008, many people in the USA lost almost everything. When you hold several of your properties under overseas banking, after that you are lowering the danger of losing everything when a situation strikes your country.

/800px-ING_Group_structure-6e6ce02cb1104164b37dd278744adc9b.png)

The 9-Minute Rule for Opening Offshore Bank Account

Keep your wealth out of reach with overseas financial. Various financial institutions feature numerous plans, which indicates you can improve solutions, consisting of rate of interest for deposits. And while many banks as well as monetary establishments in the USA supply virtually the very same price, seek far better prices outside the nation.

Reach comprehend the problems of your offshore bank to ensure you delight in maximum benefits. Some banks might require you not to take out any kind of quantity from your account within a year so as to make the full quantity of passion. Obtain notified, then decide. While the majority of nations in the western world are involved in unhealthy money battles, opening an overseas checking account can assist you dodge the effects.

In this case, you have two alternatives, which is spending in precious metals such as gold as well as silver or go for an arising market money account. This is the factor why we told you that you should strategize by comprehending the territory of your overseas financial institution, among other worldwide tax obligation details.